16 March, 2011 by James McBride

Gold Up, Housing Down

- Image via Wikipedia

Japan’s Nikkei jumped 5.7% after its worst two-day performance since 1987. However, investor sentiment in the region remains uncertain, given the ongoing crisis at the crippled Fukushima Daiichi nuclear plant. Other indexes also showed gains. The Shanghai Composite added 1.2%, South Korea’s Kospi gained 1.8%, and Hong Kong’s Hang Seng had a 0.1% rise. European stocks have had modest declines. Traders have taken cues from a downgrade of Portugal’s debt, with Moody’s slashing its rating by two degrees to “A3.” Spain’s IBEX 35 was off 1.2%, the French CAC 40 shed 0.8%, London’s FTSE 100 was down 0.7%, and the German DAX was fractionally higher. (more…)

12 February, 2009 by admin

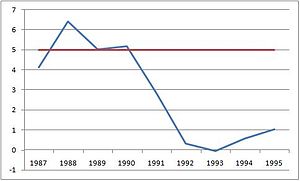

U.S. Stocks, Overseas Trading Dismal

Equity option activity on the CBOE saw 1,194,387 call contracts traded on Wednesday, compared to 925,811 put contracts. The put/call ratio rose to 0.78, while the 21-day moving average slipped to 0.76. Gold futures have reached their highest price in 7 months as uncertainty over the bailout plan jump-started a new round of safe-haven buying. The April contract piled on $30.30, or 3.3%, to finish at $944.50 per ounce, while the front-month February contract gained $30.10 to settle at $943.80 per ounce.

Overseas trading has been dismal. Stocks plunged in Tokyo and Hong Kong with exporters and financials leading the downtrend. Strength in the Japanese yen helped pressure a number of companies. In addition, Japan’s wholesale inflation rate fell more than expected in January, dipping into negative territory for the first time in more than 5 years. In Europe, indices racked up their third day of losses as falling oil prices hold back the energy sector and corporate earnings create additional drag on stocks.

Against this backdrop, we again feel that the Direxion Shares Financial BEAR 3x ETF (FAZ) 09 MAR 65.0 covered calls continue to look interesting. They are currently up +4.93 to 48.48 and offer a 174.6% if unchanged annual return and a 585.5% if assigned annual return.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=1c371210-54f2-48b2-b7b6-281b293cc2af)