3 December, 2021 by The TZ Newswire Staff Comments Off on Market Analysis Report (03 Dec 2021)

Market Analysis Report (03 Dec 2021)

Wall Street Banks Explore Bitcoin-Backed Loans | South Korea Delays Crypto Tax Plans | Mercado Pago’s Brazil-Based Users Can Now Buy, Sell, and Hold Crypto

14 October, 2021 by The TZ Newswire Staff Comments Off on Revolve Games Adds New Dimensions to Play-to-Earn Blockchain Gaming

Revolve Games Adds New Dimensions to Play-to-Earn Blockchain Gaming

PRESS RELEASE. Playing games has taken another dimension entirely through a new play-to-earn model that makes earning generating crypto revenue easier than ever.

16 March, 2011 by James McBride

Gold Up, Housing Down

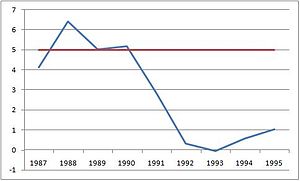

- Image via Wikipedia

Japan’s Nikkei jumped 5.7% after its worst two-day performance since 1987. However, investor sentiment in the region remains uncertain, given the ongoing crisis at the crippled Fukushima Daiichi nuclear plant. Other indexes also showed gains. The Shanghai Composite added 1.2%, South Korea’s Kospi gained 1.8%, and Hong Kong’s Hang Seng had a 0.1% rise. European stocks have had modest declines. Traders have taken cues from a downgrade of Portugal’s debt, with Moody’s slashing its rating by two degrees to “A3.” Spain’s IBEX 35 was off 1.2%, the French CAC 40 shed 0.8%, London’s FTSE 100 was down 0.7%, and the German DAX was fractionally higher. (more…)

17 September, 2010 by James McBride

The Brave New World Of Trading

Over the last few years the world has changed dramatically for traders. New places to trade, much cheaper prices, combined with a wide range of uniquely focused (some might say, exotic) product offerings have consistently expanded profit opportunities for traders of all experience levels.

And despite the upheaval caused to some in the industry over the past dozen or so years (in particular, the old-school brokers), these changes seem to have been extremely beneficial to the markets at large. No question, digital technology has helped make trading much simpler and more accessible for both individuals and larger entities alike.

As evidence, look to the array of Internet brokers that offer round-the-clock, browser-based order fills. An online smorgasbord of underlying instruments that, up until just a few years ago was only accessible to the most sophisticated managers, is now available to most traders. And real-time market-data providers now offer timely and consistent updates from around the globe. Add to this the fact that hundreds (possibly thousands) of developers and software publishers have sprung up in recent years to create programs that help traders crunch all of this data together in hopes of making huge profits. (more…)

28 May, 2009 by James McBride

Investor’s Business Daily Strikes Syndication Deal

Investor’s Business Daily, publisher of in-depth financial news geared to personal and professional investors, recently announced a partnership with Mochila, a premium content syndication technology platform and network, to distribute IBD’s multimedia offerings to online readers who want up to the minute market information.

Using content from Investor’s Business Daily’s companion website, Investors.com, Mochila and Investor’s Business Daily are creating an investment management site section featuring regularly refreshed articles, photos and video. The program will kick off with 14 charter websites and is expected to grow to 40 over the course of the year-long deal.

- Image via CrunchBase

Investor’s Business Daily is known for its proprietary stock screens, comparative performance ratings and has a record of identifying stock leaders as they emerge. IBD’s companion website, Investors.com, offers stock tools and research for investors of every level. These include the IBD University learning center, IBD TV market videos and audio interviews, intraday reports on market action and the IBD Stock Checkup.

IBD also hosts popular investment workshops and provides Home Study programs based on their top-performing growth strategy, the CAN SLIM Investing System. The Mochila-powered multimedia channels will incorporate a mix of themes, ranging from stock trading and technology news to investor psychology.

20 April, 2009 by James McBride

Most Actively Managed Equity Funds Fail To Perform

According to a new report from Standard & Poor’s, more than 70% of all actively managed U.S. equity mutual funds trailed their benchmarks for the five years ending 2008. The S&P’s Index Versus Active Fund Scorecard (SPIVA) showed that 71.9% of actively managed large-cap funds lagged the S&P 500, while 75.9% of actively managed mid-cap funds trailed the S&P MidCap 400. In addition, 85.5% of actively managed small-cap funds fell behind the S&P SmallCap 600.

The only bright spot was Large-Cap Value ETFs, which did better than the S&P 500 Value index in 2008, with 78% of actively managed funds beating their benchmark. S&P says the results were consistent with the previous five-year cycle which ran from 1999 to 2003. The results of the study prompted an S&P spokesperson to speculate that the belief that bear markets strongly favor active management is largely a myth.

Check out IndexUniverse.com for more on this story.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=273eb177-29eb-404a-b153-92ebcf982f24)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=f6720cb6-54e6-4f06-83d7-662c0d2bfd62)