5 April, 2016 by The TZ Newswire Staff Comments Off on Personal Finance Daily: How to livestream football games, and what a few hundred dollars can change

Personal Finance Daily: How to livestream football games, and what a few hundred dollars can change

How to livestream football games, and what a few hundred dollars can change.

read more

5 April, 2016 by The TZ Newswire Staff Comments Off on UK data: BRC Shop Price Index (March): -1.7% y/y (prior -2.0%)

UK data: BRC Shop Price Index (March): -1.7% y/y (prior -2.0%)

BRC-Nielson Shop Price Index

– A slowing of price deflation

– For the m/m, in at flat (0% change for March), prior -0.1%

5 April, 2016 by The TZ Newswire Staff Comments Off on One Solar Company that Flew Too Close to the Sun

One Solar Company that Flew Too Close to the Sun

Unlike First Solar or SunPower, this company got a little too excited.

5 April, 2016 by The TZ Newswire Staff Comments Off on The Nattering Naybobs Of Normalization (A Tale Of 3 Fed Heads)

The Nattering Naybobs Of Normalization (A Tale Of 3 Fed Heads)

Authored by Bill Bonner of Bonner & Partners (annotated by Acting-Man.com’s Pater Tenebrarum),

Leaning Into the Wind

During our lifetime, three Fed chiefs have faced a similar challenge.

Each occupied the chairman’s seat at a time when “normalization” of interest rates was in order.

5 April, 2016 by The TZ Newswire Staff Comments Off on Write-Offs: 4.5.16

Write-Offs: 4.5.16

Iceland PM resigns over offshore investments; New inversion rules test pending deals; United flight attendant leaves packed plane in Houston on emergency slide; and more.

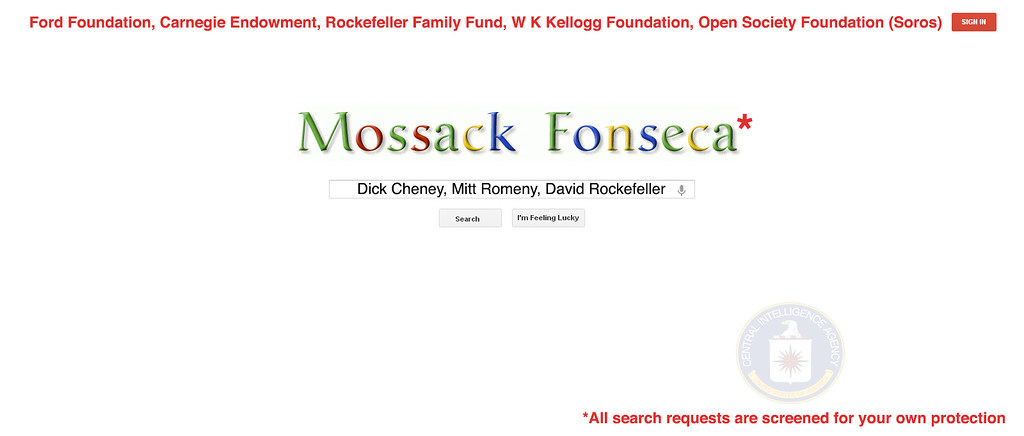

5 April, 2016 by The TZ Newswire Staff Comments Off on MoSSaCK FoNSeCa SeaRCH

MoSSaCK FoNSeCa SeaRCH

5 April, 2016 by The TZ Newswire Staff Comments Off on WSJ on "Subprime-Housing Risks Raise Red Flags in China"

WSJ on "Subprime-Housing Risks Raise Red Flags in China"

This is from the Wall Street Journal on subprime lending in China. Not new, but a catch-up on what’s happening

– A surge in risky subprime-style loans

– Home buyers in China normally put down a third of the cost of a new property upfront. But a rapid rise in buyers borrowing for their down payments … has led authorities to clamp down.

Like I said, not new, but it looks like its not going away.