Published in TZ Latest News 19 April, 2022 by The TZ Newswire Staff Comments Off on : Many airlines are dropping masks and two-thirds of employers have, too — here’s where mask mandates remain in effect

: Many airlines are dropping masks and two-thirds of employers have, too — here’s where mask mandates remain in effect

Some public health experts are dismayed about a judge’s ruling on mask mandates and its implications

read more

Published in TZ Latest News 19 April, 2022 by The TZ Newswire Staff Comments Off on Coronavirus Update: Experts dismayed by response to face-mask mandate ruling as airlines immediately drop requirement — in some cases midflight

Coronavirus Update: Experts dismayed by response to face-mask mandate ruling as airlines immediately drop requirement — in some cases midflight

Experts were dismayed Tuesday at the response to a federal judge ruling that struck down the U.S.

Published in TZ Latest News 19 April, 2022 by The TZ Newswire Staff Comments Off on Sun Country Airlines Announces First Quarter 2022 Conference Call Date

Sun Country Airlines Announces First Quarter 2022 Conference Call Date

MINNEAPOLIS, April 19, 2022 (GLOBE NEWSWIRE) — Sun Country Airlines (NASDAQ: SNCY) today announced that it will hold its first quarter 2022 earnings call on May 5, 2022

Published in Options · Real Estate · TZ Featured Lists 26 January, 2021 by The TZ Featured Staff Comments Off on 12 Alternatives for LendingClub Investors

12 Alternatives for LendingClub Investors

Published in Options · TZ Featured Lists 24 September, 2020 by The TZ Featured Staff Comments Off on A New Era of Media Begins With Tokenization

A New Era of Media Begins With Tokenization

Substack alone won’t save publishing: The future of online content is where “money legos,” communities and media meet.

Published in Options · TZ Featured Lists 11 August, 2020 by The TZ Featured Staff Comments Off on Passive Income via Digital Wealth: A Deep Dive Into Crypto Earning, Staking, Interest Bearing Accounts

Passive Income via Digital Wealth: A Deep Dive Into Crypto Earning, Staking, Interest Bearing Accounts

read more

read more

Published in TZ Resources 13 March, 2021 by The TZ Resources Staff Comments Off on Xangle

Xangle

The Xangle platform helps projects communicate with their stakeholders in crystal clarity. The added clarity improves efficiency that ultimately leads to an air of accountability from which all stakeholders can extract benefit daily.

Published in TZ Resources 27 December, 2018 by The TZ Resources Staff Comments Off on connected investors

connected investors

Real estate investing has a predictable rhythm, a pattern of events and situations. Every deal is unique, however the core elements remain the same.

Connected investors accelerates the cycle by removing roadblocks and providing direct connections to what you need to complete your first or next real estate investment transaction.

Published in TZ Resources 17 October, 2018 by The TZ Resources Staff Comments Off on Rooting Out Rigged Markets

Rooting Out Rigged Markets

Texas Finance Professor Sifts Data for Signs of Rigged Markets

Published in Business Features 16 March, 2011 by James McBride

Gold Up, Housing Down

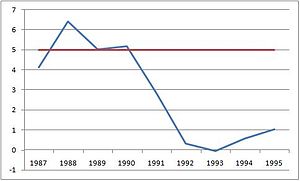

- Image via Wikipedia

Japan’s Nikkei jumped 5.7% after its worst two-day performance since 1987. However, investor sentiment in the region remains uncertain, given the ongoing crisis at the crippled Fukushima Daiichi nuclear plant. Other indexes also showed gains. The Shanghai Composite added 1.2%, South Korea’s Kospi gained 1.8%, and Hong Kong’s Hang Seng had a 0.1% rise. European stocks have had modest declines. Traders have taken cues from a downgrade of Portugal’s debt, with Moody’s slashing its rating by two degrees to “A3.” Spain’s IBEX 35 was off 1.2%, the French CAC 40 shed 0.8%, London’s FTSE 100 was down 0.7%, and the German DAX was fractionally higher. [Read more →]

Published in Business Features 17 September, 2010 by James McBride

The Brave New World Of Trading

Over the last few years the world has changed dramatically for traders. New places to trade, much cheaper prices, combined with a wide range of uniquely focused (some might say, exotic) product offerings have consistently expanded profit opportunities for traders of all experience levels.

And despite the upheaval caused to some in the industry over the past dozen or so years (in particular, the old-school brokers), these changes seem to have been extremely beneficial to the markets at large. No question, digital technology has helped make trading much simpler and more accessible for both individuals and larger entities alike.

As evidence, look to the array of Internet brokers that offer round-the-clock, browser-based order fills. An online smorgasbord of underlying instruments that, up until just a few years ago was only accessible to the most sophisticated managers, is now available to most traders. And real-time market-data providers now offer timely and consistent updates from around the globe. Add to this the fact that hundreds (possibly thousands) of developers and software publishers have sprung up in recent years to create programs that help traders crunch all of this data together in hopes of making huge profits. [Read more →]

Published in Stocks 19 February, 2010 by James McBride

Trading Site, StockTwits, Continues To Draw Attention

- Image via CrunchBase

After breaking away from Twitter awhile back, the investing site StockTwits is rolling out a number of new features that it hopes will draw in more traders. The site, still in beta and billed as a real time platform for stock traders to share information, has a desktop AIR application that includes video, news and charts.

Following the acquisition of Chart.ly last year, StockTwits acquired the small but influential financial news site Abnormal Returns in January of 2010. AR features curated news as well as original content about the financial markets and stocks. StockTwits is reportedly taking that platform and adding its real time news and information feed from the StockTwits network.

The company has raised $4.6 million over three rounds of funding and was originally built on top of the Twitter platform. In late 2009 they launched a desktop version of the product and moved to their own messaging platform. In addition to contributing trading strategies via blog posts and video, some of the things StockTwits users will be able to do on the new site are watching suggested user streams, perusing charts shared by other users, checking out specific filtered ticker pages and watching the 24-hour StockTwits TV stream.

Related articles by Zemanta

- StockTwits Evolves, Becomes Must Use Site For Traders (techcrunch.com)

- Abnormal Returns gets even better (blogs.reuters.com)

- StockTwits Buys Financial Blog Abnormal Returns (paidcontent.org)

- With Its Desktop App, StockTwits Grows Up…And Away From Twitter (techcrunch.com)

- Blogonomics: Monetize via acquisition (blogs.reuters.com)

read more

read more

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=578738a5-c849-41d4-84af-f0330a4b4fd9)